The Dimensional Difference

Every investment strategy at Dimensional is driven by a research-backed approach designed to maximize returns while minimizing costs and risk.

Aim higher

The Dimensional difference is the outperformance we aim to deliver over benchmarks and peers by applying the science of investing.

At Dimensional, we pursue this return advantage through a data-backed, repeatable approach to implementation that we have been fine-tuning for more than four decades. This implementation advantage has allowed us to beat the performance of both traditional active funds and passive index funds.

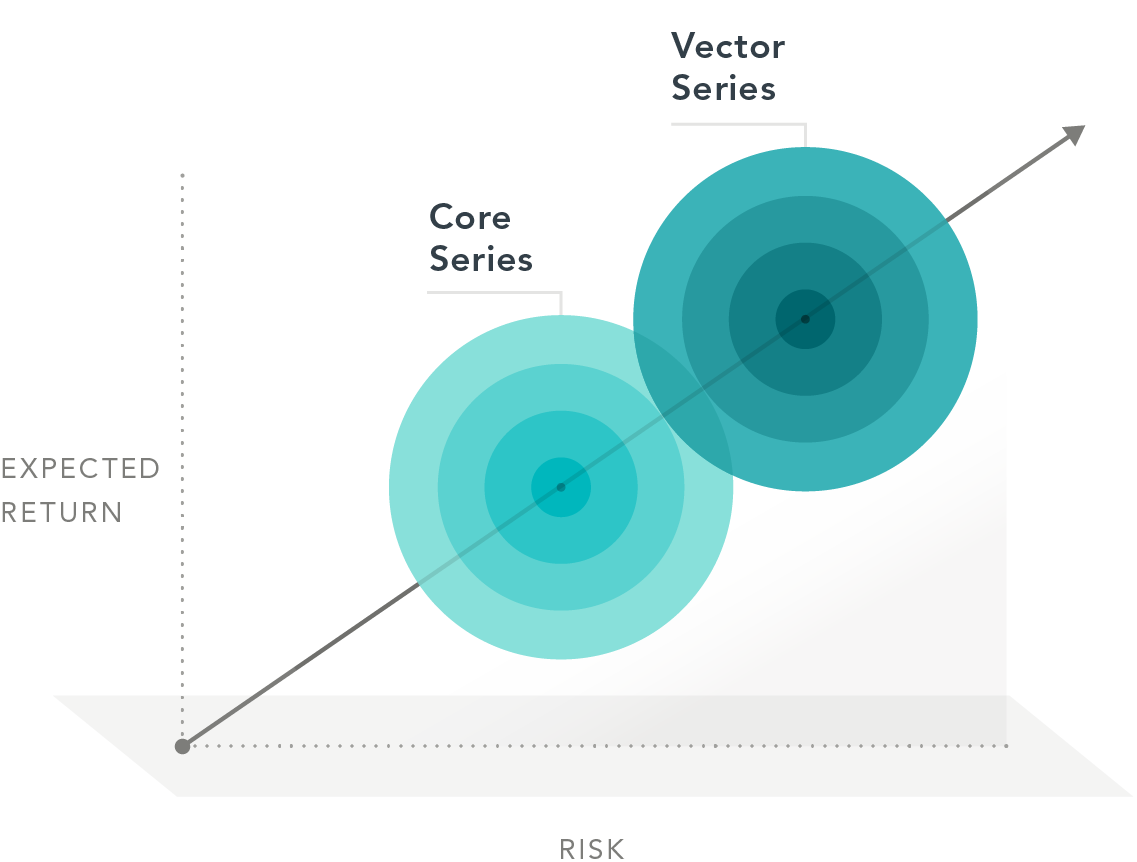

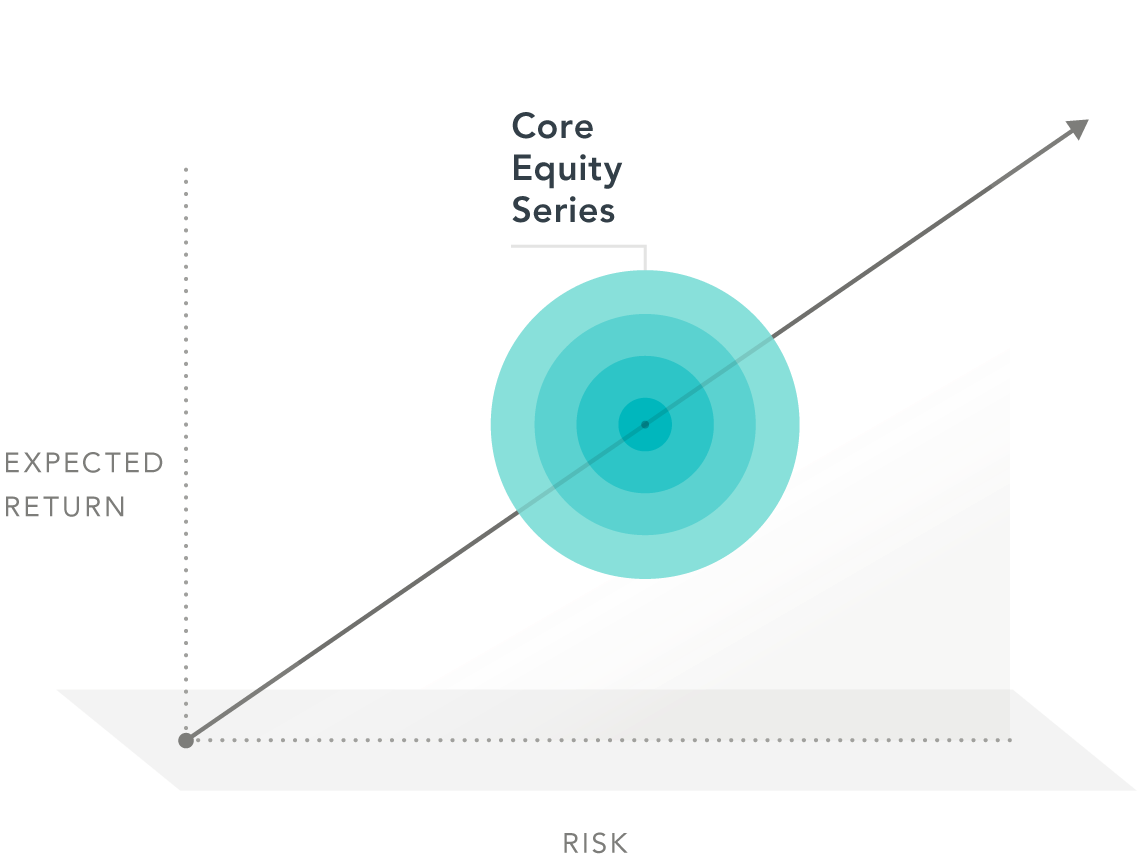

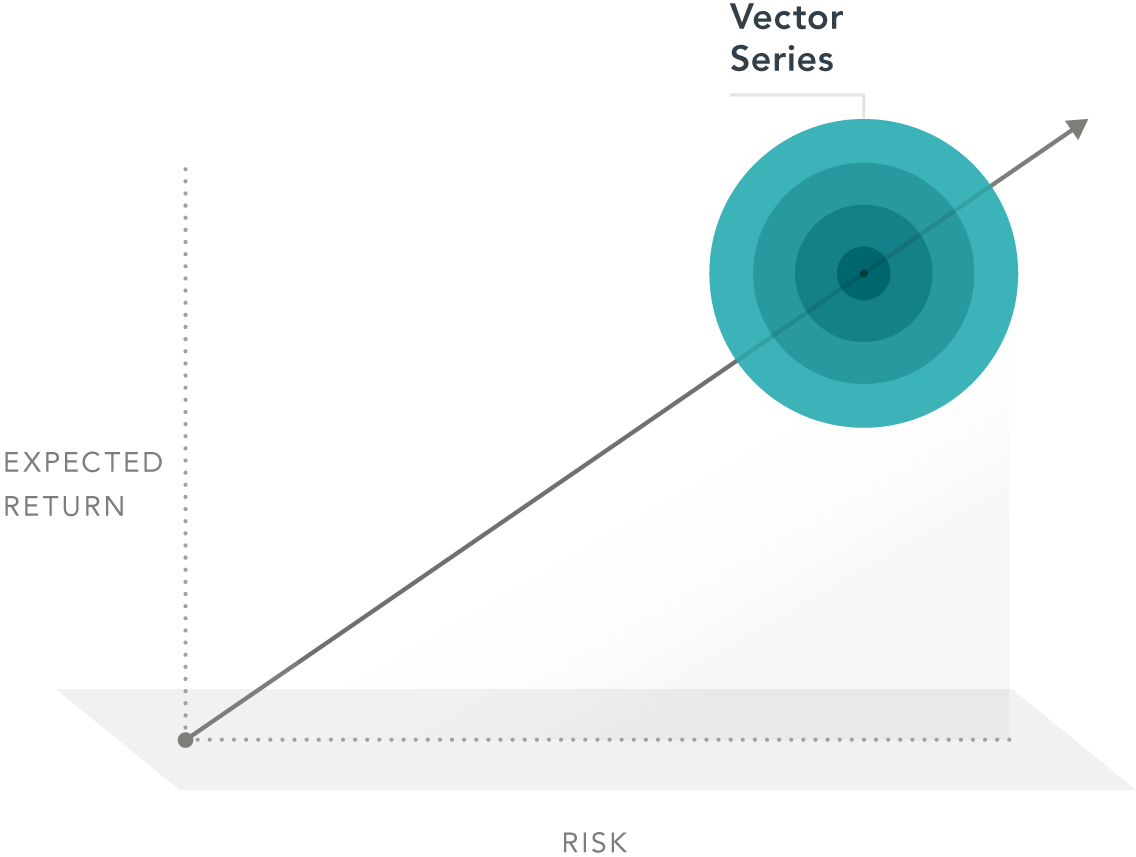

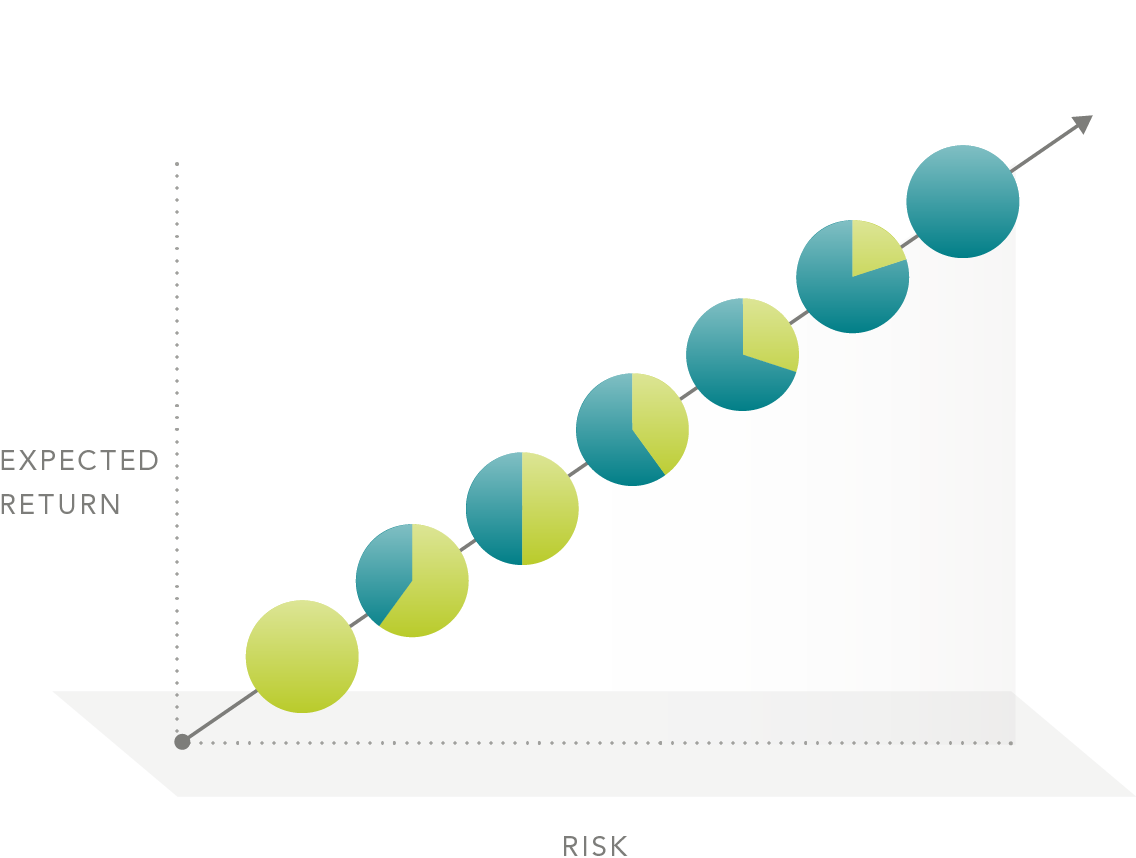

Investors can choose an equity solution based on how they want to balance risk and expected return. One type of risk is how much your portfolio deviates from the total market. We deviate from the market to pursue a higher-than-market return. But the greater the deviation, the higher the risk of underperforming at times.

Our Core Equity solutions are for investors who want to beat benchmark returns. These regional portfolios offer broad coverage of the Canadian, US, and international equity markets and pursue outperformance by overweighting stocks with higher expected returns. You can turn it up from there with our Vector Equity funds, which have an even greater emphasis on stocks that have higher expected returns. Our Global Portfolio series is for investors seeking total investment solutions that feature a range of stock and bond allocations to match their risk and return needs.1

Choose a strategy to pursue your objectives

Footnotes

-

1. The strategies target equity allocations of 40%, 50%, 60%, 70%, 80%, and 100%, relative to fixed income. The series also includes a World Equity Portfolio, which reflects 100% allocation to equities based on world market cap weights.

DISCLOSURES

There is no guarantee strategies will be successful. Diversification neither assures a profit nor guarantees against loss in a declining market.

Risks include loss of principal and fluctuating value. Investment value will fluctuate, and shares, when redeemed, may be worth more or less than original cost. Small and micro cap securities are subject to greater volatility than those in other asset categories. Value investing is subject to risk which may cause underperformance compared to other equity investment strategies. Fixed income securities are subject to increased loss of principal during periods of rising interest rates. Fixed income investments are subject to various other risks, including changes in credit quality, liquidity, prepayments, call risk, and other factors.

This material is issued by Dimensional Fund Advisors Canada ULC for registered investment advisors, dealers, and institutional investors and is not intended for public use. The other Dimensional entities referenced herein are not registered resident investment fund managers or portfolio managers in Canada.

This material is not intended for Quebec residents.

Nothing on this website shall constitute or serve as an offer to sell products or services in any country or jurisdiction by any Dimensional global firm. For informational purposes only. All information is given in good faith and without warranty and should not be considered investment advice or an offer of any security for sale.