Dimensional ETFs

Go beyond indexing®

Dimensional’s exchange-traded funds (ETFs) are built on 40 years of experience using financial science to pursue higher expected returns for investors.

ETFs at a Glance

As of December 31, 2025

Largest

Active ETF manager

41

Active ETFs

$243B

In ETF Assets Under Management

USD (in billions)

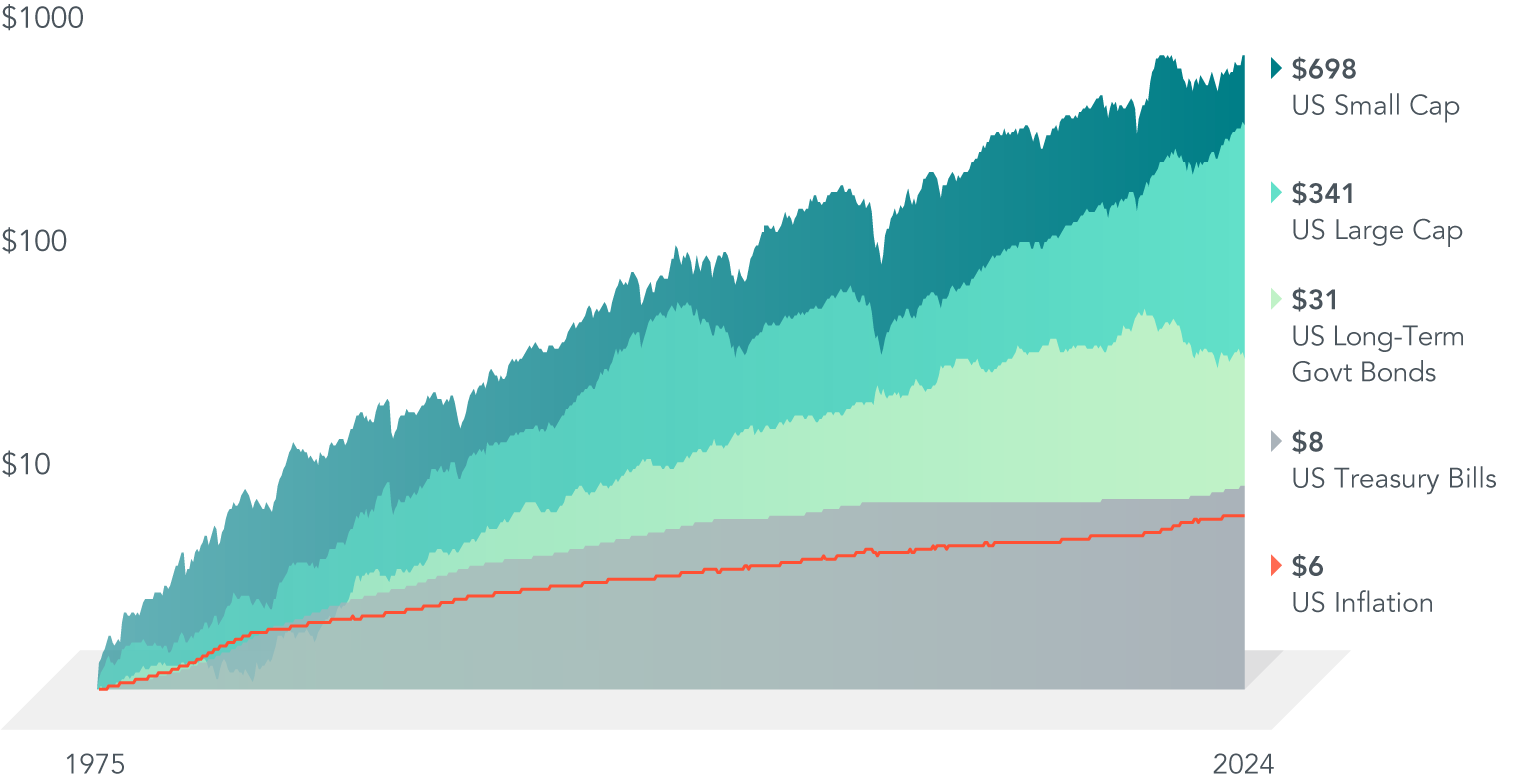

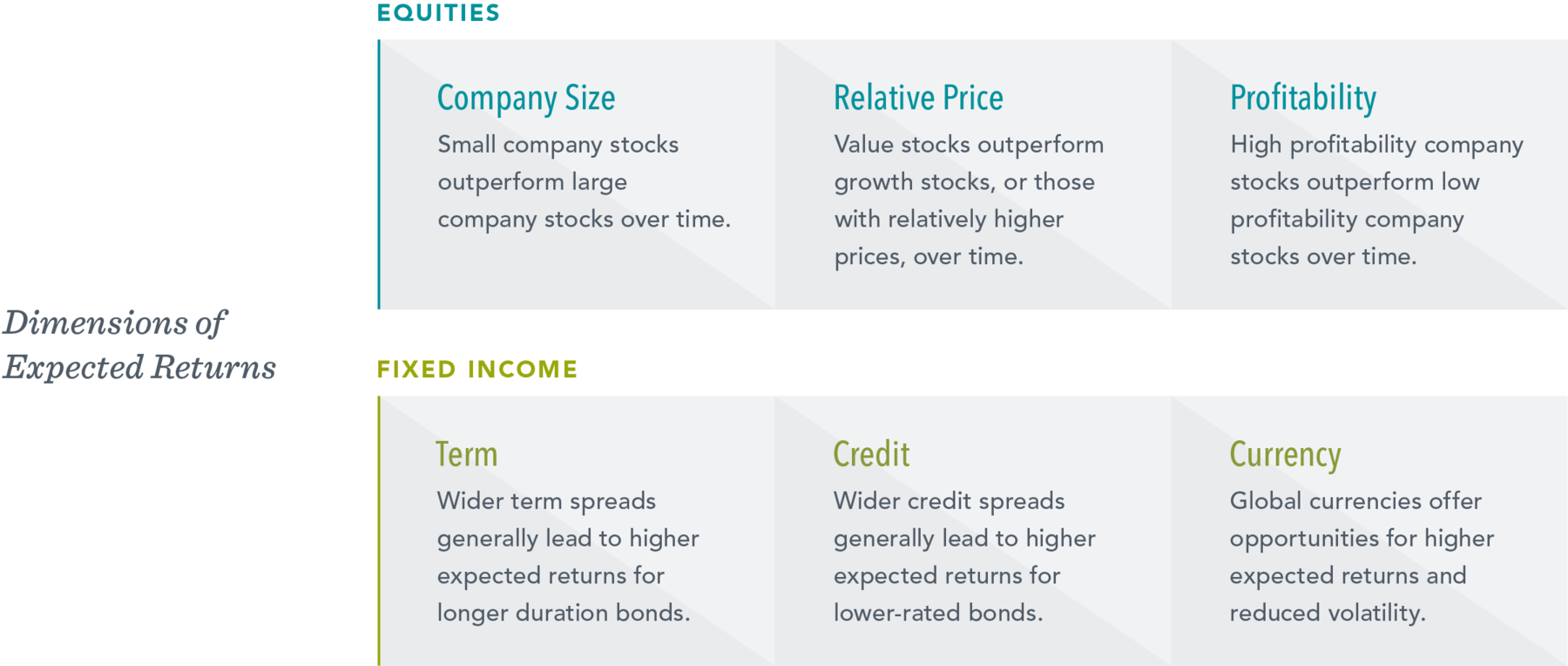

Market prices contain reliable information that can be used to position portfolios toward outperformance.

Learn More:

Every day, we manage our strategies through a flexible process that allows us to consistently focus on reducing costs and controlling risks.

Learn More:

All Dimensional ETFs are priced within the lowest quartile among Morningstar category peers.1

Learn More:

Our expanding ETF suite provides financial professionals with a full set of solutions to build globally diversified portfolios.

To learn more about how we work with financial professionals to deliver a better way to invest, send us a message or contact our client support team at (512) 306-4308.

Footnotes

-

1. Comparison of funds in Morningstar peer categories as of January 2, 2026.

Disclosures

Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission. Consider the investment objectives, risks, and charges and expenses of the Dimensional funds carefully before investing. For this and other information about the Dimensional funds, please read the prospectus carefully before investing. Prospectuses are available by calling Dimensional Fund Advisors collect at (512) 306-7400 or at dimensional.com. Dimensional funds are distributed by DFA Securities LLC.

This information is not meant to constitute investment advice, a recommendation of any securities product or investment strategy (including account type), or an offer of any services or products for sale, nor is it intended to provide a sufficient basis on which to make an investment decision. Investors should consult with a financial professional regarding their individual circumstances before making investment decisions.