Dimensional Wealth Models

Systematic investment solutions powered by financial science

Dimensional Models deploy globally diversified equity, fixed income, and real estate market allocations strategically to meet a range of investor goals.

Learn More:

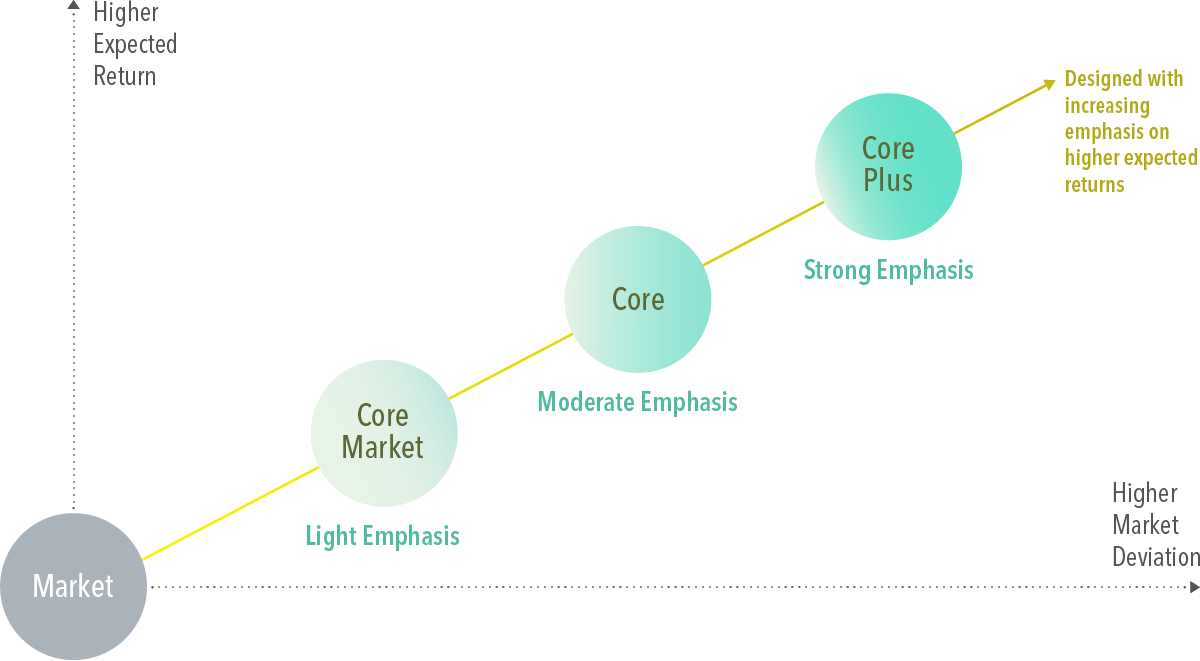

Our model portfolios integrate funds designed to outperform the broad market by focusing on drivers of higher expected returns identified by robust theoretical and empirical research.1

Learn More:

Within each fund, Dimensional uses real-time information in markets to focus daily on targeting higher expected returns, managing risks, and minimizing costs.

Learn More:

Footnotes

-

1. The equity allocations focus on size, value, and profitability considerations. The fixed income allocations look to term, credit, and currency where applicable.

Disclosures

Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission. Consider the investment objectives, risks, and charges and expenses of the Dimensional funds carefully before investing. For this and other information about the Dimensional funds, please read the prospectus carefully before investing. Prospectuses are available by calling Dimensional Fund Advisors collect at (512) 306-7400 or at dimensional.com. Dimensional funds are distributed by DFA Securities LLC.

This information is not meant to constitute investment advice, a recommendation of any securities product or investment strategy (including account type), or an offer of any services or products for sale, nor is it intended to provide a sufficient basis on which to make an investment decision. Investors should consult with a financial professional regarding their individual circumstances before making investment decisions.

Dimensional makes available certain model portfolios (“Dimensional Wealth Models”). The Dimensional Wealth Models are provided “as is.” Dimensional has no obligation to continue to maintain or take any other action with respect to the Dimensional Wealth Models and may stop providing any update of (and may cease to take any action with respect to) the Dimensional Wealth Models at any time in its sole and absolute discretion. Dimensional is not responsible for implementing the Wealth Models (e.g., selecting broker-dealers, executing trades, or seeking best execution).

The Dimensional Wealth Models are provided for informational purposes only and should not be considered investment advice, a recommendation, or an offering of any services or products for sale. The Dimensional Wealth Models are not intended as a sufficient basis on which to make an investment decision. Certain investments included in the Wealth Models may not be suitable for investors, nor do they represent a complete investment program. Investment products: • Not FDIC Insured • Not Bank Guaranteed • May Lose Value Dimensional Fund Advisors does not have any bank affiliates.

The Dimensional Research and Portfolio Management teams (the “Wealth Model Team”) developed the Dimensional Wealth Models for launch on March 31, 2020. The Wealth Model Team, with oversight from Dimensional’s Investment Committee, generally expects to select funds for the Wealth Models managed by Dimensional (“Dimensional Funds”) without considering the universe of funds sponsored by persons not affiliated with Dimensional or its affiliates (“Third-Party Funds”), even though there may or may not be Third-Party Funds that are more appropriate for inclusion in such Dimensional Wealth Models. To the extent a user implements all or part of a Wealth Model, this will generate advisory and other fees for Dimensional or its affiliate, and the management fees of Dimensional funds may be higher than fees charged by Third-Party Funds. The Dimensional Wealth Models' asset allocations represent the selected target asset mix as determined by the Wealth Model Team and as of the date it is provided.

Use of the Wealth Models by a user does not imply that Dimensional has provided any legal, tax, or accounting advice or recommendations in relation to the Wealth Models or advice on whether it would be advisable for any institutional investor, registered investment advisor (“Advisor”), or client of the Advisor to invest in any Wealth Model or Dimensional Funds. The Dimensional Funds selected for a Dimensional Wealth Model may not perform as well as, and may be subject to higher fees and expenses than, other investment products that could have been selected for such Dimensional Wealth Model, including potentially Third-Party Funds. Users of the Wealth Models shall be responsible for independently determining the appropriateness of a Wealth Model and any Dimensional Funds for such users or their clients. Institutional investors and Advisors shall be responsible for rebalancing portfolios for themselves or their clients.

Dimensional is providing information in the form of Dimensional Wealth Models as ideas for possible construction of portfolios centered on the Dimensional Funds and not as investment advice or research. Dimensional is not providing any investment, tax, or financial advice to any institutional investor, Advisor, or any client of the Advisor, and has no obligation to, and will not take into account the tax status, investment goals, or other characteristics of, any Advisor or any client of the Advisor when compiling the Dimensional Wealth Models. Dimensional is not acting as a fiduciary to any institutional investor, Advisor, or any client of the Advisor, nor is any institutional investor, Advisor, or any client of the Advisor entering into any type of advisory or other relationship with Dimensional. The investment decisions made by any institutional investor, Advisor, or any client of the Advisor based on the Dimensional Wealth Models provided shall be at the institutional investor’s, Advisor’s, or such client’s own risk, and Dimensional makes no guarantee as to the merits of any Wealth Model or Dimensional Funds selected for a Wealth Model.

The information herein does not constitute a recommendation from Dimensional Fund Advisors LP. The risk of the Wealth Models is subject to the risk of the Dimensional Funds, which can be found in the applicable prospectuses, and the selection of Dimensional Funds and the allocation and reallocation of Wealth Model assets may not produce a desired result.