The Dimensional Difference

Every investment strategy at Dimensional is driven by a research-backed approach designed to maximise returns while minimising costs and risk.

Aim higher

The Dimensional difference is the outperformance we aim to deliver over benchmarks and peers by applying the science of investing.

At Dimensional, we pursue this return advantage through a data-backed, repeatable approach to implementation that we have been fine-tuning for more than four decades. This implementation advantage has allowed us to beat the performance of both traditional active funds and passive index funds.

How many funds beat their benchmark over the past 20 years?

Index Funds

Indexers only try to match a benchmark, not beat it.

Traditional Active Funds

14%

Dimensional Funds

75%

US domiciled mutual funds and US domiciled ETFs are not offered for sale outside the US. Past performance is no guarantee of future results.

Solutions to match investors’ goals

Investors can choose from a wide range of solutions to pursue their portfolio goals. Our strategies include targeted Component Equity, broad-market Core Equity, and Multi-Asset allocations.

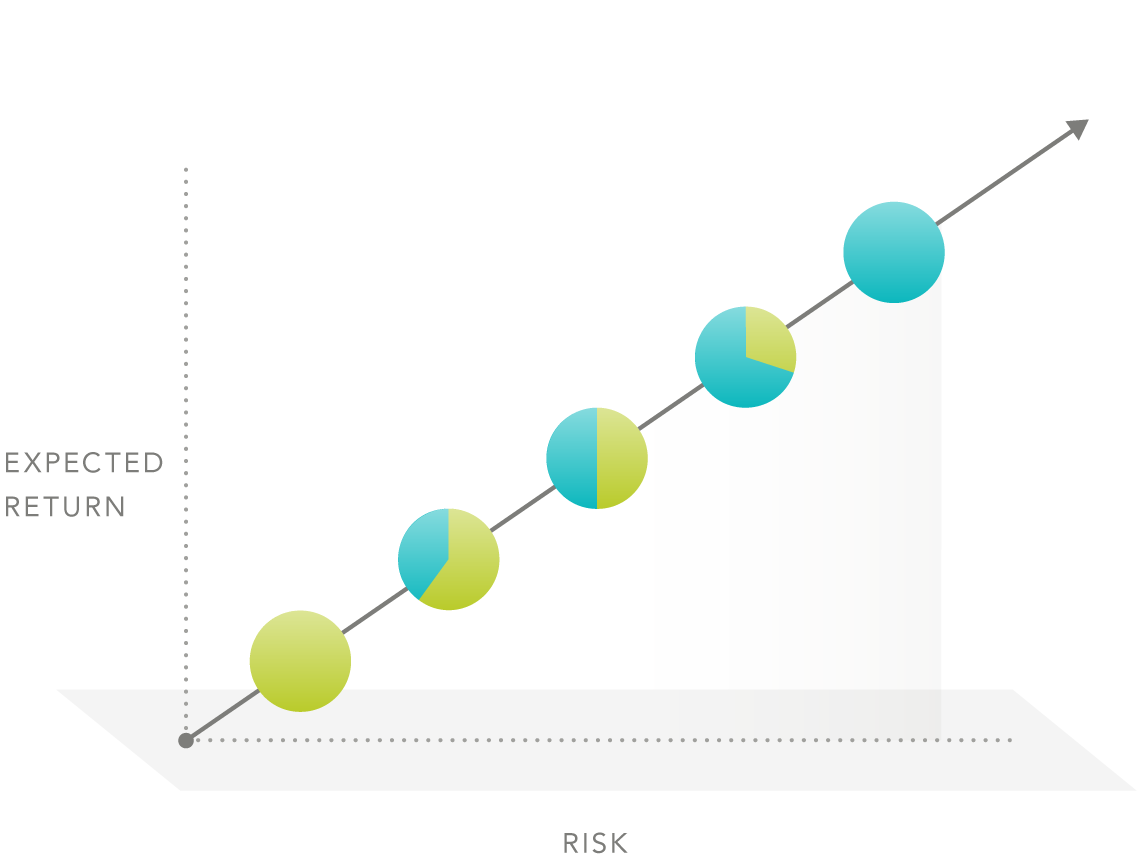

Dimensional’s multi-asset strategies target higher expected returns through allocations with a range of weights to stocks or bonds. These allocations allow for varying risk tolerances—a greater equity allocation is associated with greater risk, but also greater potential return.

These strategies are available as managed funds through Dimensional’s World Allocation Trusts.

Footnotes

-

1. The strategies target equity allocations of 30%, 50%, 70%, and 100%, relative to fixed income. The series also includes a World Equity Trust, which reflects 100% allocation to equities based on world market cap weights.

glossary

Diversification: Holding many securities or types of investments in a portfolio, often for the purpose of mitigating risk associated with owning a single security or type of investment.

Relative price: A company’s price, or the market value of its equity, in relation to another measure of economic value, such as book value.

Profitability: A company’s operating income before depreciation and amortisation minus interest expense scaled by book equity.

Expected return: An estimate of average anticipated returns informed by historical data.

DISCLOSURES

Investments involve risks. The investment return and principal value of an investment may fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original value. Past performance is not a guarantee of future results. There is no guarantee strategies will be successful.

Diversification neither assures a profit nor guarantees against loss in a declining market.

The material contained on this site has been issued by DFA Australia Limited (AFS Licence No.238093, ABN 46 065 937 671).

Investors should also consider the Product Disclosure Statement (PDS) and the target market determination (TMD) that has been made for each financial product either issued or distributed by DFA Australia Limited prior to acquiring or continuing to hold any investment. Go to dimensional.com/funds to access a copy of the PDS or the relevant TMD. Any opinions expressed in this material reflect our judgement at the date of publication and are subject to change.

Nothing on this website shall constitute or serve as an offer to sell products or services in any country or jurisdiction by any Dimensional global firm. For informational purposes only. All information is given in good faith and without warranty and should not be considered investment advice or an offer of any security for sale.