The Dimensional Difference

Every investment strategy at Dimensional is driven by a research-backed approach designed to maximise returns while minimising costs and risk.

Aim higher

The Dimensional difference is the outperformance we aim to deliver over benchmarks and peers by applying the science of investing.

At Dimensional, we pursue this return advantage through a data-backed, repeatable approach to implementation that we have been fine-tuning for more than four decades. This implementation advantage has allowed us to beat the performance of both traditional active funds and passive index funds.

How many funds beat their benchmark over the past 20 years?

Index Funds

Indexers only try to match a benchmark, not beat it.

Traditional Active Funds

14%

Dimensional Funds

75%

US domiciled mutual funds and US domiciled ETFs are not offered for sale outside the US. Past performance is no guarantee of future results.

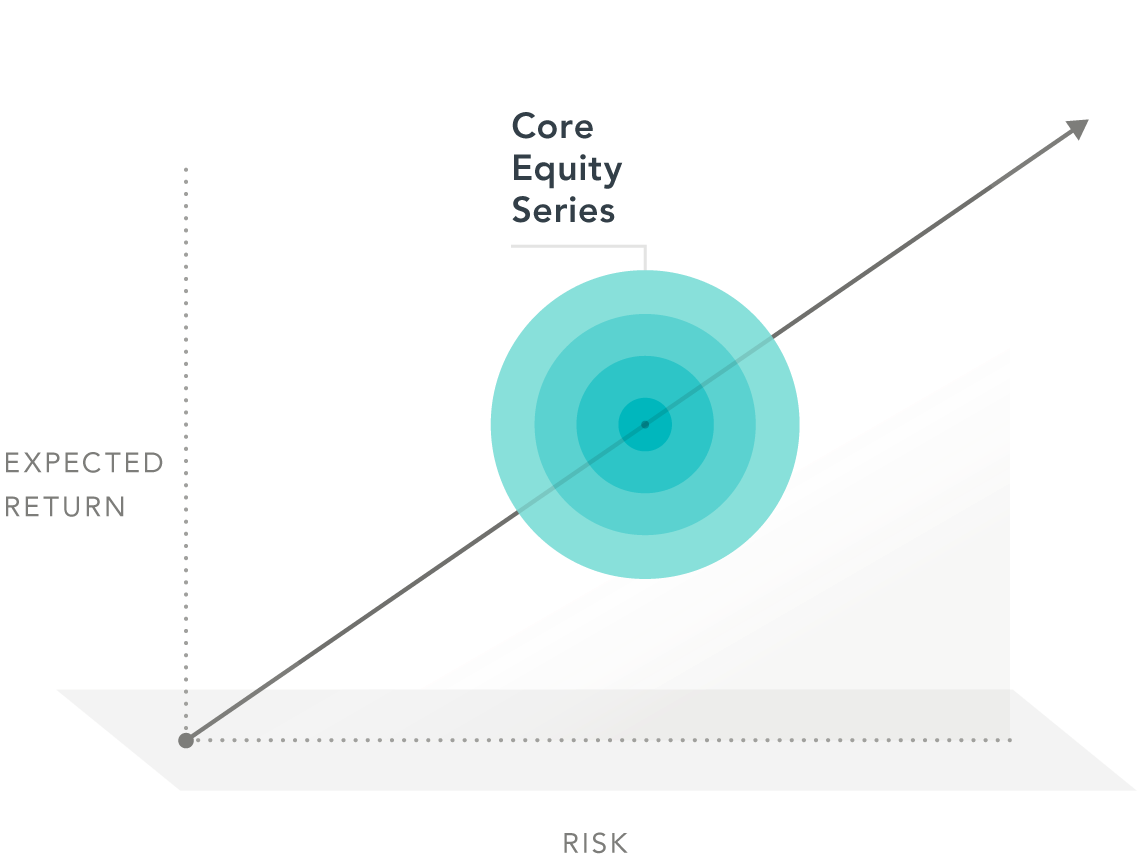

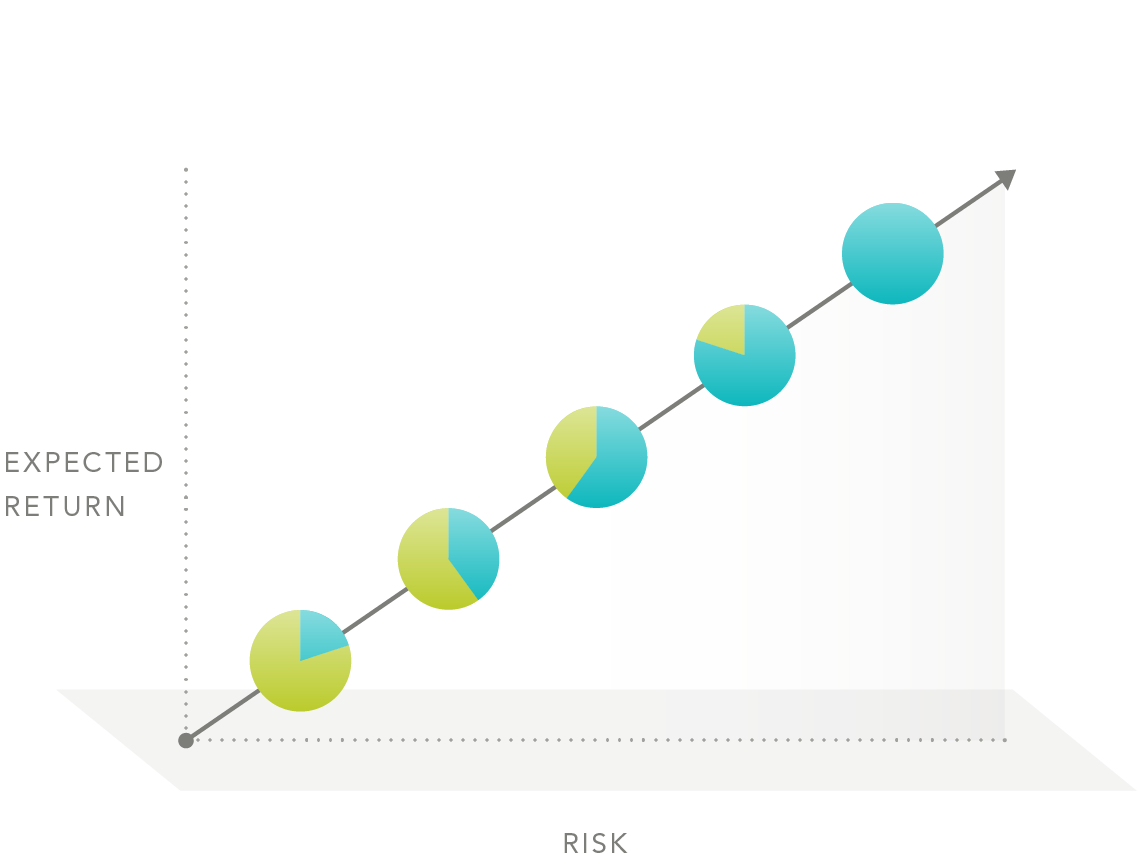

Solutions to match investors’ goals

Investors can choose from a wide range of solutions to pursue their portfolio goals. Our strategies include broad-market Core Equity, targeted Component Equity, and Multi-Asset allocations.

These strategies are available as managed funds through Dimensional’s World Allocation Funds or Dimensional Wealth Models.

Access the benefits of Dimensional Investing in a wide range of vehicles

A full range of investment solutions backed by financial science

To learn more about how we work with financial professionals to deliver a better way to invest, send us a message. Alternatively, contact our client service team at +44 (0) 20 3033 3300.

Footnotes

-

1. The strategies target equity allocations of 20%, 40%, 60%, and 80%, relative to fixed income. The series also includes the World Equity Fund, which reflects a 100% allocation to equities based on world market cap weights.

glossary

Diversification: Holding many securities or types of investments in a portfolio, often for the purpose of mitigating risk associated with owning a single security or type of investment.

Relative price: A company’s price, or the market value of its equity, in relation to another measure of economic value, such as book value.

Profitability: A company’s operating income before depreciation and amortisation minus interest expense scaled by book equity.

Expected return: An estimate of average anticipated returns informed by historical data.

DISCLOSURES

Investments involve risks. The investment return and principal value of an investment may fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original value. Past performance is not a guarantee of future results. There is no guarantee strategies will be successful.

Diversification neither assures a profit nor guarantees against loss in a declining market.