Dimensional ETFs

Go beyond indexing

Dimensional’s exchange-traded funds (ETFs) are built on 40 years of experience using financial science to pursue higher expected returns for investors.

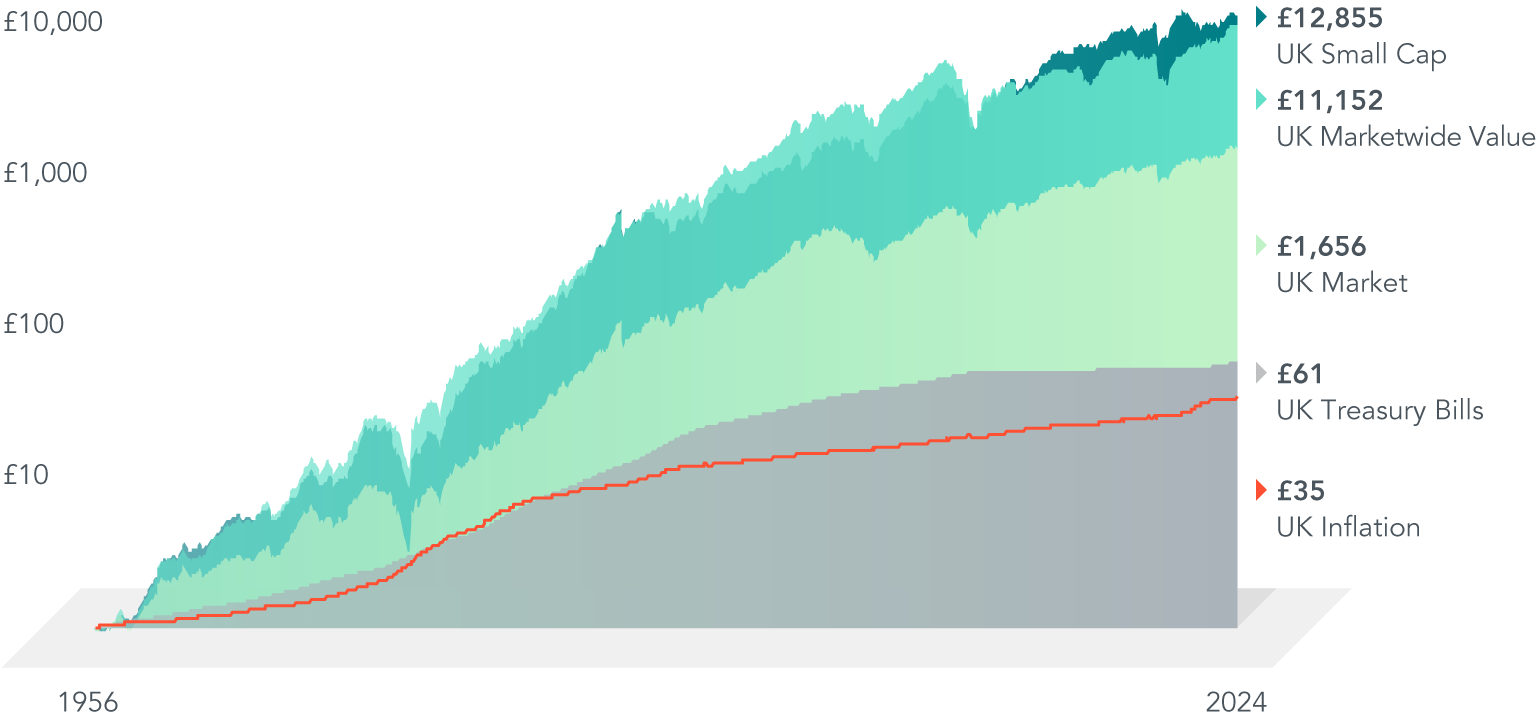

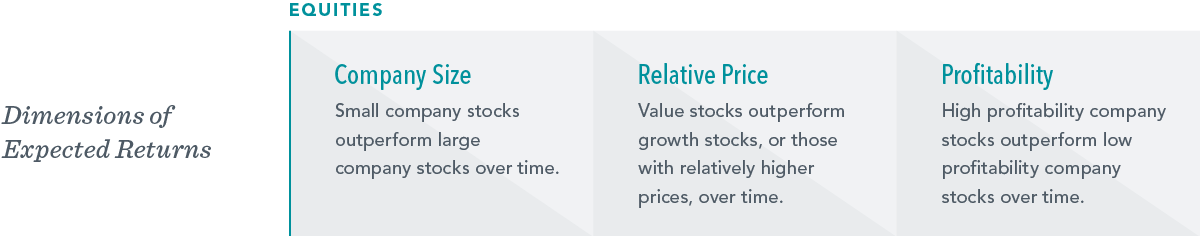

Higher Expected Returns

Market prices contain reliable information that can be used to position portfolios toward outperformance.

Learn More:

Flexible Daily Process

Every day, we actively manage our strategies through a flexible process that allows us to focus on reducing costs and minimising risks.

Learn More:

Broad Diversification

Our broadly diversified portfolios make investment outcomes more reliable while offering portfolio managers and traders rebalancing options that add value.

Learn More:

Explore Our ETFs

Our ETFs provide financial professionals with a cost-effective way to invest in thousands of stocks globally.

Connect With Us

To learn more about how we work with financial professionals to deliver a better way to invest, contact our Client Services team via the web form or on +44 (0) 20 3033 3300.